Written by Matt Raver

Managing Director

In the aftermath of the 2008 financial crisis, a considerable amount of attention was directed at remuneration within the financial services industry. Big bonuses for greedy bankers made good tabloid headlines. Individuals such as Fred Goodwin, the head of RBS, were turned into pantomime villains and the regulators were portrayed as incompetent.

Political will heavily influenced regulatory change, including the European Union’s adoption of a framework covering remuneration; an approach not embraced in other jurisdictions including the USA. Affected financial institutions must have in place remuneration policies that are consistent with good risk management, promote healthy firm cultures and discourage poor conduct. In the UK, the framework was rolled out for the largest banks, building societies and investment firms in 2010, and it was then extended to other firms, including asset managers, market makers and brokers, in 2011.

There are currently five separate ‘remuneration codes’ for FCA regulated firms. There is also a sixth regime derived from the Second Markets in Financial Instruments Directive that focuses on those selling investment products and services to retail clients. Some investment firms are not subject to a remuneration code, including ‘Exempt CAD’ firms whose activities are restricted to receiving and transmitting orders, and advising on investments.

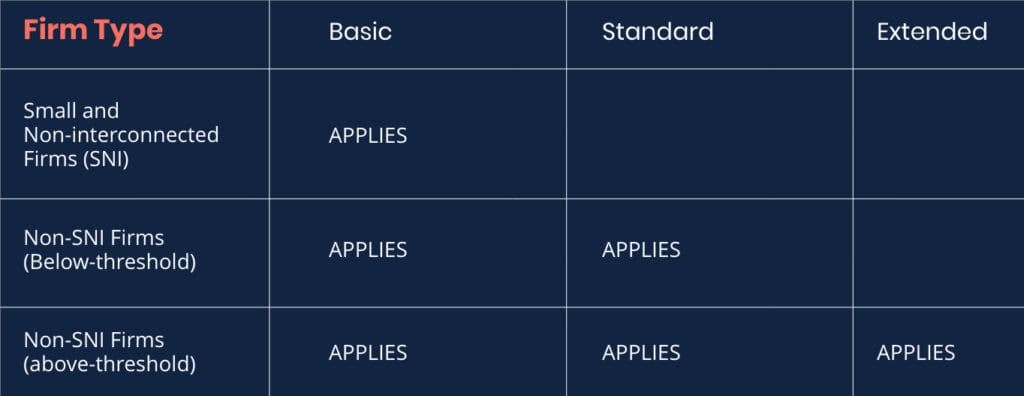

For investment firms, this set-up is changing. The Investment Firms Prudential Regime, which takes effect in January 2022, aims to update and simplify the prudential requirements for all investment firms. Regarding remuneration requirements, the FCA has announced that it intends to apply a ‘tiered’ approach – the components of the new regime applying to a firm will depend upon that firm’s categorisation:

The distinction between the SNI and Non-SNI designation is determined with reference to certain criteria, which are applied on either a firm specific of group-wide basis, dependent upon individual circumstances. As an example, many asset managers will be an SNI firm if their assets under management is less than £1.2 billion. A majority of investment firms will fall into this category.

The ‘thresholds’ for distinguishing between the two categories of Non-SNI firms are set at a level such that there will be a small number of ‘above-threshold’ firms – the FCA estimates that there will be just 101 such firms.

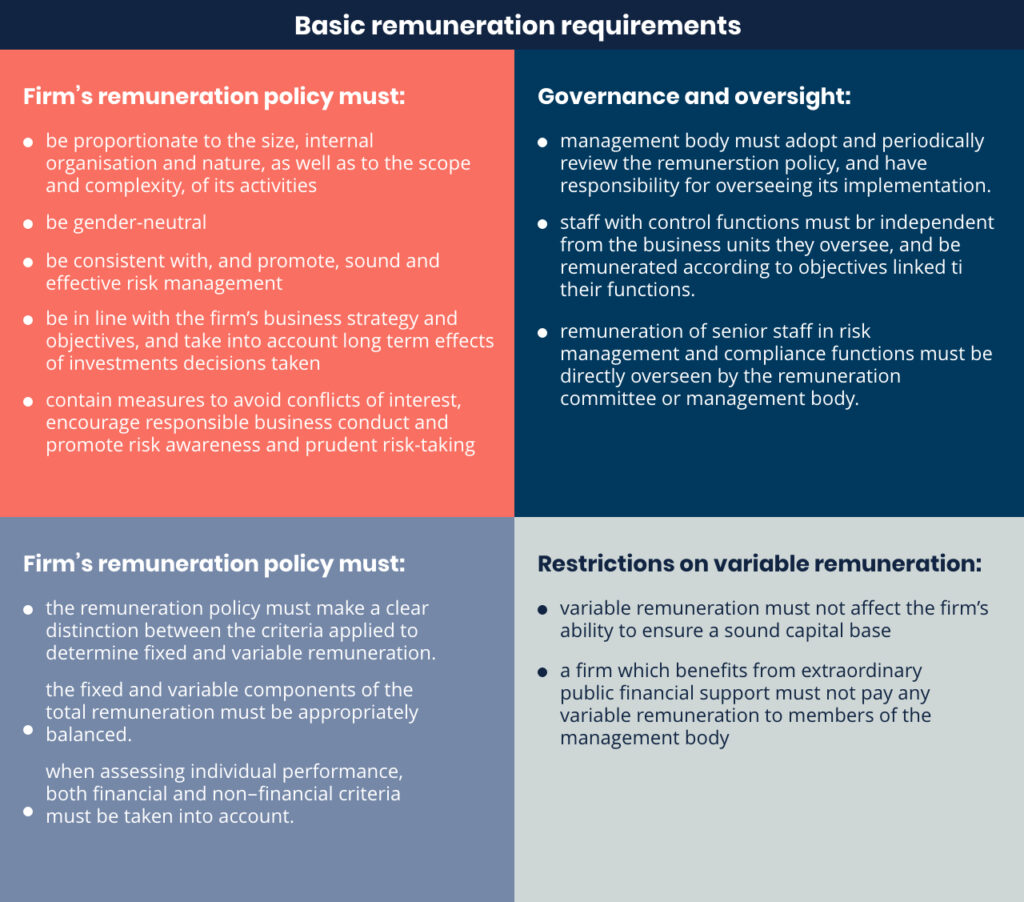

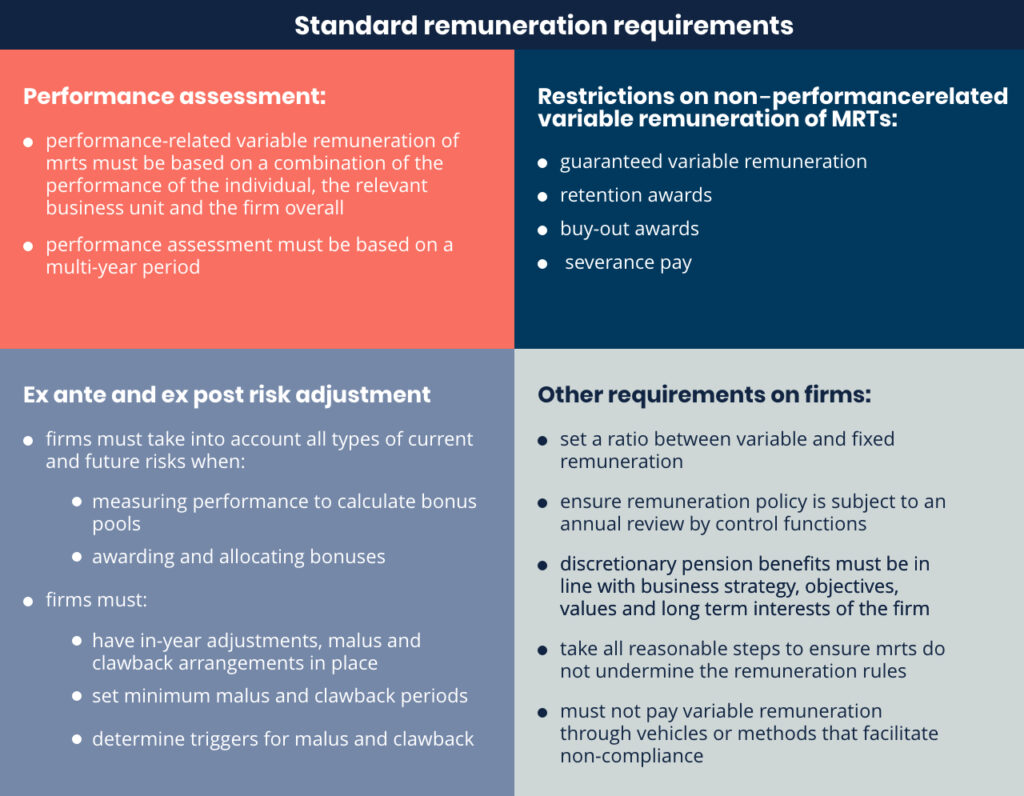

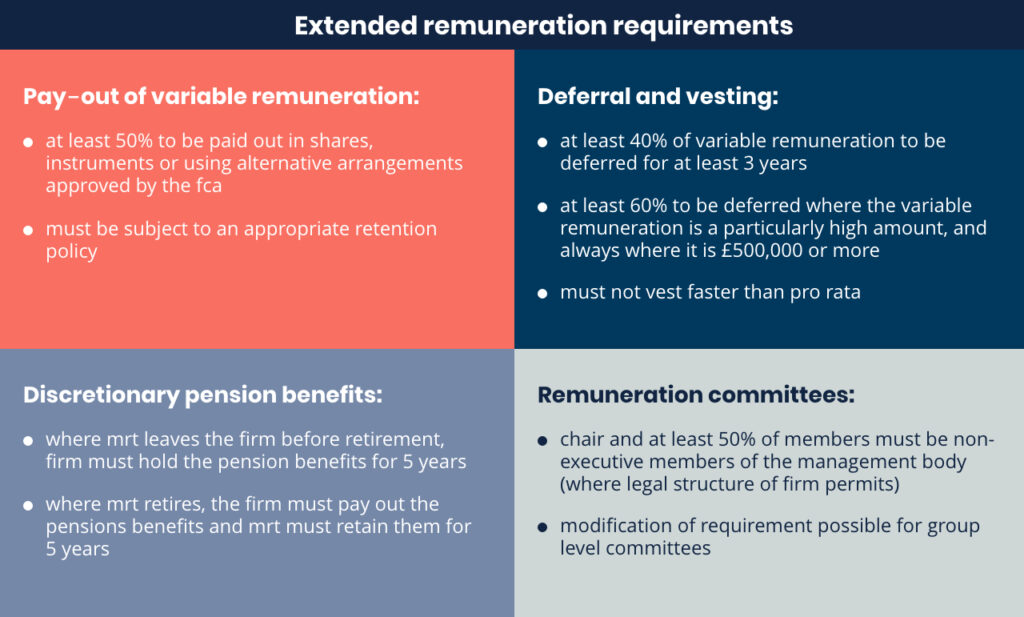

The ‘Basic’, ‘Standard’ and ‘Extended’ remuneration requirements are set out below; most or all of these requirements will be familiar to firms currently subject to a remuneration code:

The ‘basic’ remuneration requirements tend to be more principles-based in nature. As a result, SNI firms will have considerable discretion on how to apply the requirements. Many SNI firms that are currently subject to a remuneration code will find that the new remuneration framework will not be as onerous as is the case currently.

The ‘standard’ and ‘extended’ requirements are more prescriptive in nature. The most onerous and historically contentious requirements fall into the ‘extended’ category, including the so-called ‘pay-out process requirements’ covering part-payment of variable remuneration in financial instruments and the part-deferral of variable remuneration.

Collective portfolio management investment firms (CPMIs) which are authorised as full-scope AIFMs or UCITS management firms, and can also perform certain other investment services, will be subject to two remuneration codes: the code derived from AIFMD; and the relevant code from the new framework. How these apply to any given staff member will depend upon whether the individual works on the ‘AIFMD’ side of the business, the ‘MiFID’ side, or both sides.

The FCA consulted with the industry on the ‘tiered’ approach, and received positive feedback. Whilst the FCA continues to take remuneration seriously – it is conceptually very closely aligned with culture, conduct and accountability which are regulatory ‘hot topics’ – a majority of firms can adopt a pragmatic, principles-based framework.

This represents a radical departure from the regulatory philosophy post-financial crisis, which saw investment firms grouped with banks, credit unions and other credit institutions, despite the respective firm types often having very different risk profiles. Investment firms were often able to apply proportionality to the requirements based upon their size, nature and characteristics. However this created inconsistent outcomes. By creating a tiered approach, the end result might be that the regulatory outcomes will be more aligned with the risk of harms, whilst reducing the burden for smaller, less risky firms.

Click for more on our FCA Compliance services.